A Glimpse into the Future: How Brazil Surprised Me with Digital Innovation

Over the past year and a half, I spent a total of nine months in Brazil—a country often perceived as trailing behind in terms of infrastructure and public services. But to my surprise, Brazil proved to be a showcase of modernity and digital innovation in ways that even parts of Europe struggle to match.

While I went in expecting challenges, bureaucracy, or the usual “developing country” inefficiencies, I came back impressed—and, honestly, a bit frustrated with how things still work back in the Czech Republic.

Let me share a few things that genuinely blew my mind in Brazil—and how they’ve made returning to Europe feel a bit like stepping back in time.

Digital ID and Driver’s License: Truly Paperless Living

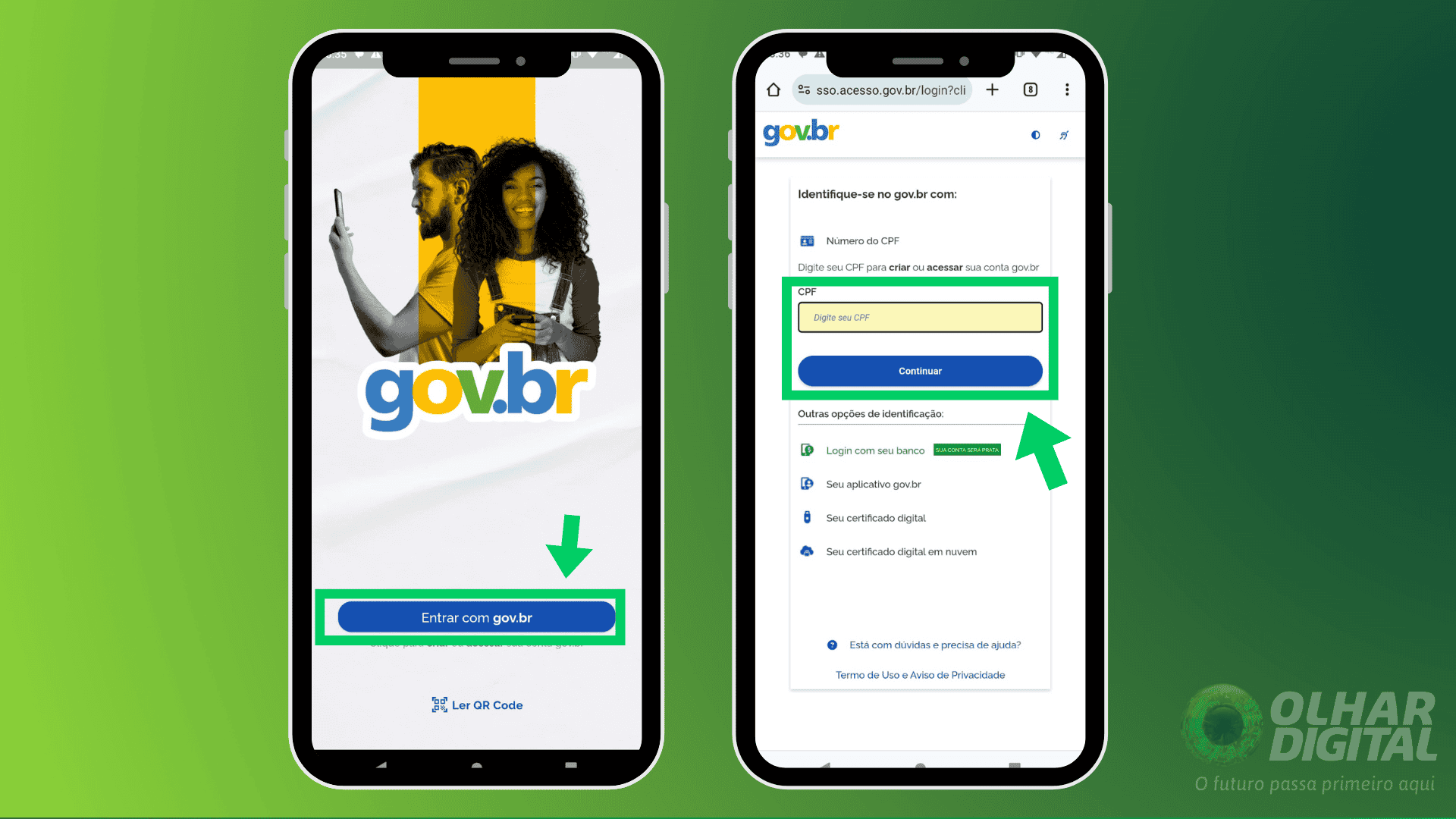

In Brazil, you’re no longer required to carry physical documents. Yes, that’s right—your national ID and driver’s license are now fully digital, accessible through the official gov.br app. It’s recognized everywhere from police stops to airport check-ins.

At first, it felt strange walking around without a wallet. But I quickly realized I didn’t need it—literally every establishment accepts card payments, and mobile payments like Apple Pay and Google Pay are so ubiquitous that cash has become the exception, not the rule. Brazil also has a QR based instant bank transfer method called PIX, without any fees for the sender and for the receiver, which is also widely accepted and preferred in many establishments. Friend lending money to each other will offer say "can you send me a PIX?".

Compare that to the Czech Republic: digital identification isn’t even an option for foreigners, and you’re expected to carry physical documents basically everywhere. It feels unnecessarily outdated—especially for a country that prides itself on digitalization. Card and digital payments are only more widely accepted now thanks to COVID-19, where handing over things to each other was avoided during the pandemic. But to this date in 2025, you can still find establishments that only accept cash payments.

Smart Locks: Biometrics Are Becoming the Norm

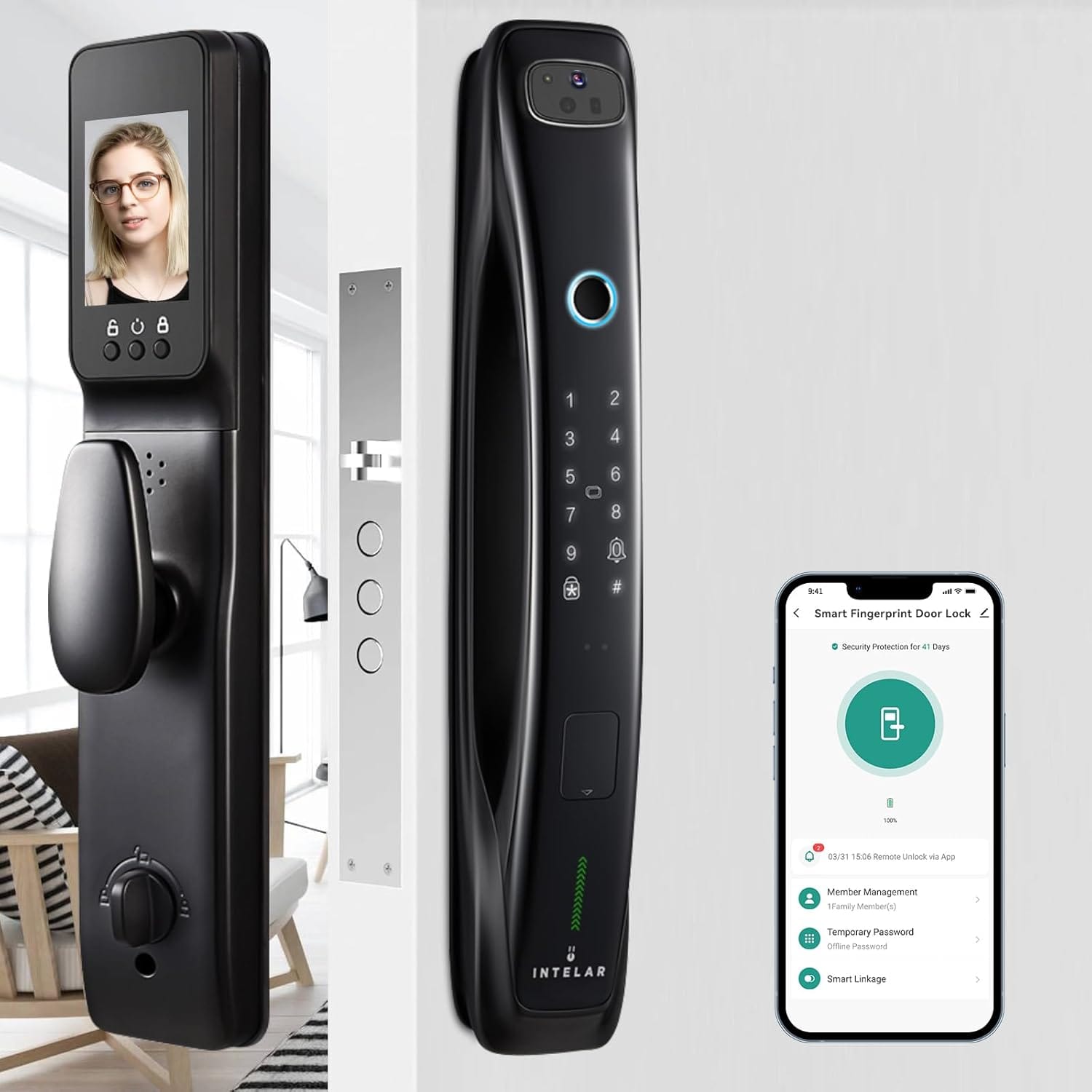

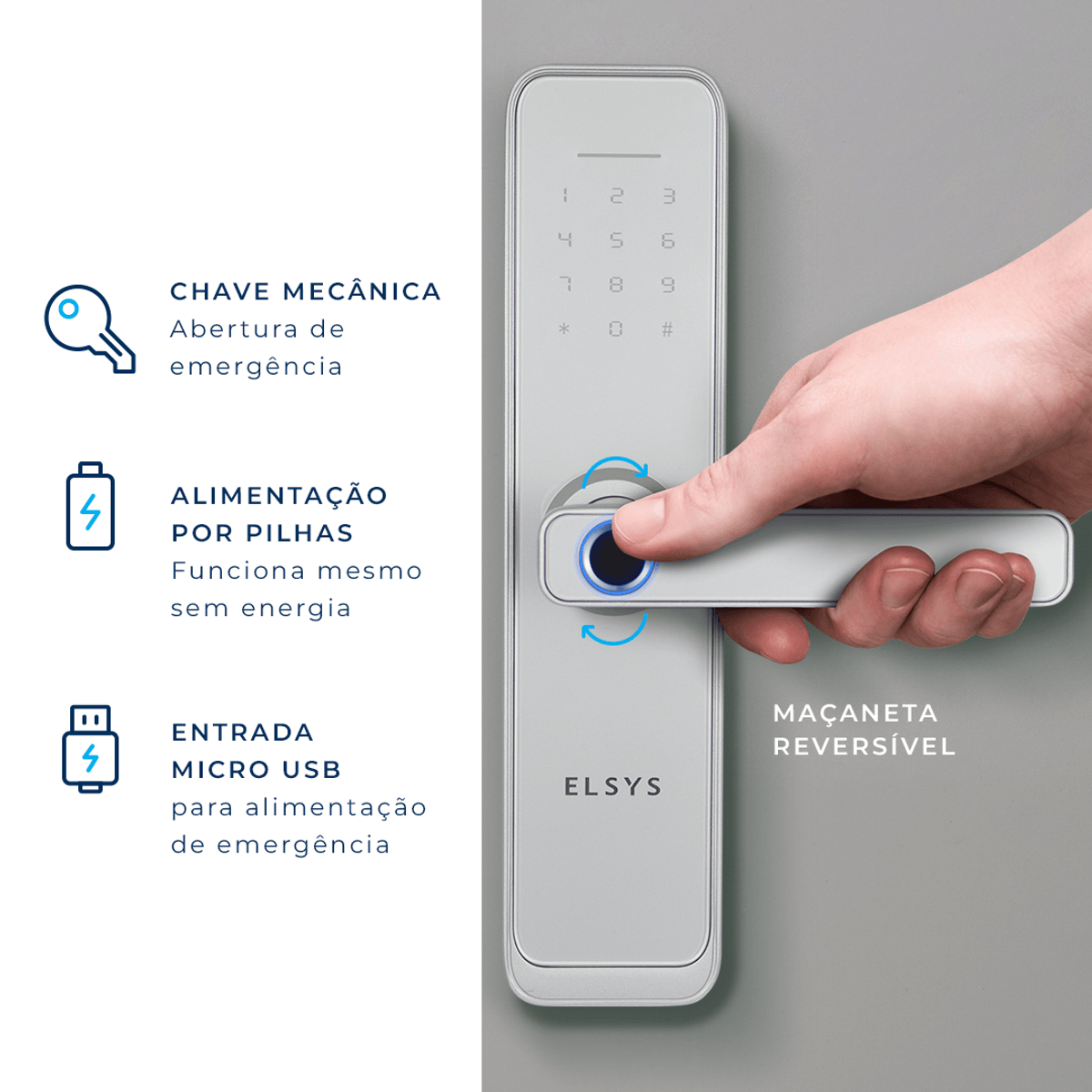

Another modern convenience I wasn’t expecting in Brazil? Smart locks. From apartment buildings to individual units and even businesses, keyless entry systems—especially facial recognition locks—have become surprisingly common.

In our apartment, we didn’t have to carry keys at all. The building entrance had facial recognition, and the unit itself was unlocked using a mobile app, a keypad or a fingerprint sensor. It was seamless, secure, and saved time besides keeping our pockets empty.

In Prague? Installing such systems in rental buildings is often discouraged or outright prohibited. Traditional keys are still the standard, mainly 'special security keys' that cost more than 1000 CZK to replace in case you lose them and innovation is slow to catch on. A bit ironic, considering how many Czechs work in advanced tech fields. The closest thing we have in Czech Republic to digital locks is NFC based chips to open the common doors in apartment buildings.

Fintech Revolution: Brazil is Years Ahead

Brazil’s banking and fintech sector feels light-years ahead of most of Europe.

Whereas many European banks still rely on clunky interfaces and charge monthly fees for basic services, Brazilian fintechs have revolutionized financial services:

- You can send payment links via WhatsApp or email in seconds.

- Creating invoices and receiving card payments via your iPhone using Tap to Pay is as easy as opening an app.

- Opening a business account or managing finances online is streamlined and fast—with customer service that actually responds.

Even traditional banks in Brazil have adapted to this digital-first reality. Meanwhile, in the Czech Republic, having a business account still means paying your bank just to hold your money, without receiving any real value in return.

And Then, Back to the Czech Republic…

Returning to Prague, I was reminded of how much digital convenience I had taken for granted.

- Digital ID for foreigners? Not available.

- Smart locks? Rare and likely not allowed in your apartment building.

- Business banking? Basic, uninspired, and expensive for no good reason.

- Accepting payments as a small business? A headache unless you use an international fintech—and even then, you can’t get a local CZK account number, which is a deal-breaker for legal and tax reasons.

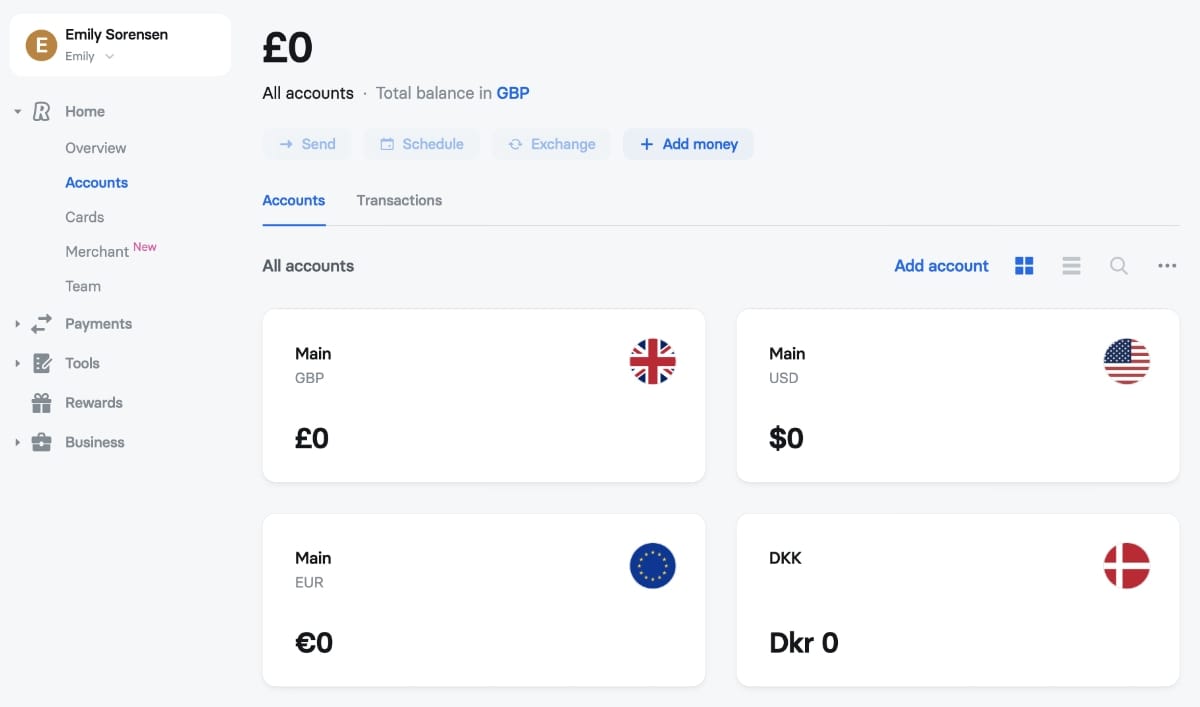

I briefly considered switching my company banking to Revolut so I could enjoy payment links and accept credit card payments on the web and on my iPhone. But the lack of a CZK bank account number made that impossible under Czech business regulations.

Europe: Both Ahead and Behind

There’s no question that Europe leads the world in many ways—sustainability, public infrastructure, social protections. But in the realm of digital services, fintech, and day-to-day convenience, many parts of the continent feel oddly stuck in the past.

Brazil, despite all its challenges, has shown that bold steps toward modernization can be taken—and that when governments and tech companies work together, the results can be transformative.

Here’s hoping that more countries in Europe start learning from the Global South instead of assuming they’ve already figured it all out.